Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the AAFM Chartered Wealth Manager CWM_LEVEL_2 Questions and answers with ExamsMirror

Exam CWM_LEVEL_2 Premium Access

View all detail and faqs for the CWM_LEVEL_2 exam

685 Students Passed

85% Average Score

98% Same Questions

Section A (1 Mark)

Which ONE of the following in not the requirement for managing customer?

Section C (4 Mark)

In addition to social security benefits of $6,000, Mr. and Mrs. Lopez have adjusted gross income of $36,000, tax-exempt interest of $1,000 and will file a joint return.

Determine the taxable portion of their social security benefits.

Section A (1 Mark)

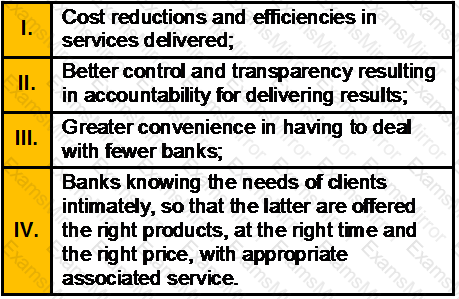

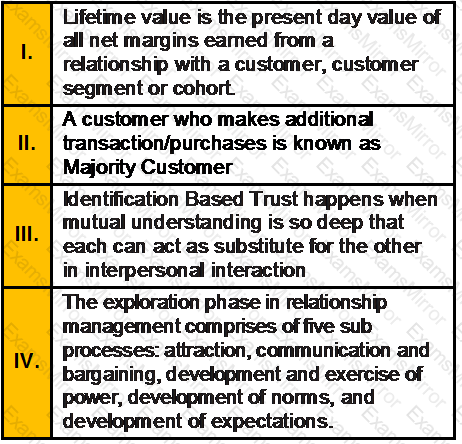

Which one of the above statements is/are not a important needs of clients in the context of relationship management:

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $ 142700 in US dollars and he is a US citizen (married Individual Filing Joint returns and Surviving Spouses)

• $ 67250 in SGD and he is a citizen of Singapore

Section B (2 Mark)

The _________ is a plot of __________.

Section B (2 Mark)

A bond has a convexity of 57.3. The convexity effect if the yield decreases by 110 basis points is closest to:

Section A (1 Mark)

Income received in India in previous year is taxable in the hands of:

Section A (1 Mark)

Unabsorbed depreciation can be carried forward for ____________.

Section A (1 Mark)

Mortgage loans:

Section A (1 Mark)

______________is a risk whenever a decision maker commits resources to a course of action (thereby making an “investment”) in the hope of achieving a positive outcome and experiences disappointing results

Section C (4 Mark)

Consider a three-month futures contract on gold. The fixed charge is Rs.310 per deposit and the variable storage costs are Rs.52.5 per week. Assume that the storage costs are paid at the time of deposit. Assume further that the spot gold price is Rs.15000 per 10 grams and the risk-free rate is 7% per annum. What would the price of three month gold futures if the delivery unit is one kg? Assume that 3 months are equal to 13 weeks.

Section C (4 Mark)

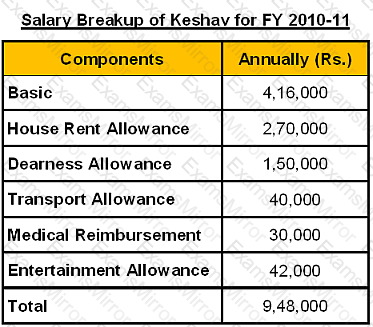

Keshav and Deepti Gohlyan approached you a Chartered Wealth Manager for preparing a Wealth plan to achieve their financial goals. Keshav Gohlyan, aged 45 years, is working in Chennai in an MNC, at a managerial level. His wife Deepti, aged 42 years, is working in a Private Company and has a post-tax income of Rs. 4 lakh p.a. She is expected to retire at the age of 55 years. Keshav’s gross salary is likely to grow at 7% p.a. and Deepti's gross salary is likely to grow at 6% p.a. The couple has two children – daughter Yogita, aged 18 years, pursuing her Graduation in Economics, and son Navneet, aged 16 years, studying in 12th standard. Navneet intends to become a Doctor.

Keshav's monthly household expenses are Rs. 40,000 out of which Rs. 8,000 is of Keshav’s personal expenses, this excludes EMI on loans and Insurance premiums. Keshav has two siblings Keshav and his family stay with his mother. His father passed away due to severe heart attack on 15-Dec-2009, at the age of 75 years, leaving a house (Value on 15thDec 2009 Rs. 25 lakh) in which they are currently staying.

Keshav has a term insurance of Rs. 20 lakh (for 20 years); the term expires 5 years from now. Both are covered under Group Medical Insurance for Rs. 4 Lakh family floater each provided by their respective employers

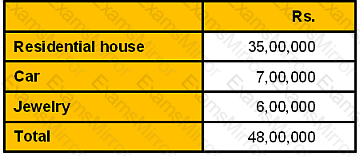

Assets

The couple’s assets as on 31-3-2010 are;

1.Cash in Hand Rs. 10,000

2.Bank balance Rs. 50,000

3.Diversified Equity Mutual Fund units at market value Rs. 2.60 lakh

4.Equity Shares at market value Rs. 15.25 lakh

5.Debt oriented Mutual Fund units at market value Rs. 1.65 lakh

6.PPF A/c balance Rs. 4.25 lakh (Keshav), Rs. 3.15 lakh (Deepti), both maturing on1st April 2016

7.ELSS Mutual Fund units at market value Rs. 75,000

8.A separate house is in the joint name of Keshav and Deepti with 50% ownership of each. This house has two floors and is let out for rent of Rs. 8,000 p.m. each floor.

Present Market Value of this House is Rs. 70 Lakh1

9.Gold Ornaments at market value Rs. 6.35 lakh

10.Car at market value Rs. 2.60 lakh

11.300 Gold ETF units purchased on 17th Oct 2006 @ 983 per unit

12.National Saving Certificates invested amount Rs. 4 lakh

13.Money back insurance plan of 20 year term with sum assured of Rs. 5 Lakh2

14.Unit linked insurance plan of 10 years with sum assured of Rs. 5 lakh3

____________________

1.Keshav and Deepti had jointly taken a housing loan of Rs. 30 Lakh to purchase the house costing Rs. 37.50 Lakh on 1st April 2003. The pay an EMI of Rs. 16,349 each, EMI date being last day of the month. The loan is for 15 years at a fixed rate of interest of 10.25%p.a.

2.Annual premium of Rs. 23,750. Paid 16 annual premiums till date before due date. The policy provides 25% of basic sum assured to insured as survival benefit after 5th, 10th, 15thyears from the start of the policy.

3.Annual premium of Rs. 35,000 p.a.

Liabilities

Housing loan outstanding: Rs. 21.36 Lakh

Goals & Aspirations:-

1.Plan for Navneet’s medical education expenses which is likely to be Rs. 3.50 lakh at theend of one year from now and increasing thereafter at 8%p.a. during the next 4years.

2.Plan for Yogita’s goal of Post-Graduation degree from abroad which is likely to cost Rs. 10 lakh in present terms required after three years.

3.Create a separate fund to provide every year post-retirement till his lifetime, vacation expenses amounting to Rs. 50,000 in current terms, such expenses increasing at the rate of 7% p.a.

4.To accumulate funds for marriage of Navneet and Yogita. For Navneet they will require in present terms Rs. 10 lakh when he attains 26 years and for Yogita he would require Rs. 15 lakh when she attains 25 years.

5.Build a retirement corpus for expenses in his post-retirement period at 75% of pre-retirement expenses at the retirement age of 60 years

Life Expectancy

Keshav: 80 years

Deepti: 78 years

Assumptions regarding long-term pre-tax returns on various asset classes:

1.Equity & Equity MF schemes/ Index ETFs11.00% p.a.

2.Balanced MF schemes9.00% p.a.

3.Bonds/Govt. Securities/Debt MF schemes7.00% p.a.

4.Liquid MF schemes5.50% p.a.

5.Gold & Gold ETF7.50% p.a.

Assumptions regarding economic factors:

1.Inflation: 5.50% p.a.

2.Expected return in Risk free instruments: 6.50% p.a.

3.Real Estate appreciation: 8.00% p.a

Cost Inflation Index

Section A (1 Mark)

Company J and Company K each recently reported the same earnings per share (EPS). Company J’s stock, however, trades at a higher price. Which of the following statements is most correct?

Section B (2 Mark)

A disadvantage of using swaps to control interest rate risk is that

Section A (1 Mark)

The covariance of market’s returns and stock returns is 0.005. The standard deviation of market’s return is 5%. What is the stock’s beta?

Section A (1 Mark)

A muslim gentleman can leave his will, bequeathing all his properties to someone often than his legal heirs to the extent of…………….

Section C (4 Mark)

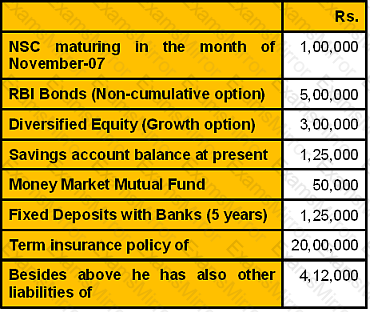

Mr. Jogen 57 years and 8 months old and going to retire after few months at the age of 58 years (after completing 33 years and 9months of service) is working as an assistant secretary in petroleum ministry. He is interested in making investments in Equity Market. Jogen purchased 100 shares of SBI Ltd. for Rs. 1,250/- per share at the beginning of the current financial year. It paid dividends of Rs. 20 per share over the year (February-08) and he sold the stock for Rs. 1,975 at the end of the year. His two children are well settled. He is staying in his own flat and has paid last installment of loan. He gets a salary of Rs. 48,000 p.m. After retirement he will get a pension of Rs. 16,000 p.m. His present (October -2007) household expenses per month are Rs. 22,000 and want to maintain same standard of living. His post-retirement expenses will be 95% of his last month’s expenses at retirement.

The present values of his physical assets are as below:

His financial assets are as follows:

He will get following amounts on his retirement:

Section B (2 Mark)

Retiring early will ____________ the accumulation phase while ____________ the retirement phase

Section A (1 Mark)

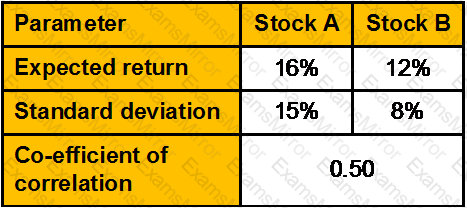

From the following data calculate the expected rate of return of a portfolio in which A and B has weights equally:

Section A (1 Mark)

Financial goals must be SMART. SMART stands for _________________

Section B (2 Mark)

The arbitrage pricing theory (APT) and the CAPM both assume all except which of the following?

Section A (1 Mark)

In which year can the subscriber to a PPF account take the first loan from the opening of the account?

Section C (4 Mark)

Read the senario and answer to the question.

Raman has invested Rs. 1,50,000, 30% of which is invested in Company A, which has an expected rate of return of 15%, and 70% of which is invested in Company B, with an expected return of 12%. What is the expected percentage rate of return?

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the tax liability of Mr. Neeraj for the A.Y.08–09 assuming that he has avail full deduction under section 80C

Section A (1 Mark)

The concept of designing marketing communication programs that coordinate all promotional activities to provide a consistent message across all audiences is called

Section A (1 Mark)

A ____________________ tax system places a relatively large tax burden on lower-income people and a relatively small tax burden on upper-income people.

Section B (2 Mark)

Which of the following factors affect the price of a stock option?

Section B (2 Mark)

Risk to bondholders comes from

Section C (4 Mark)

Suppose ABC Ltd. is trading at Rs 4500 in June. An investor, Mr. A, shorts Rs 4300 Put by selling a July Put for Rs. 24 while shorting an ABC Ltd. stock. The net credit received by Mr. A is Rs. 4500 + Rs. 24 = Rs. 4524.

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 4053

• If ABC Ltd closes at 5025

Section B (2 Mark)

Profitability Index is

Section C (4 Mark)

Mohan recommend that the stock of AZB Ltd. is a good purchase at Rs. 25. You do an analysis of the firm, determining that the Rs. 1.40 dividend and earnings should continue to grow indefinitely at 8% annually. The firm’s beta co-efficient is 1.34 and the yield on Treasury bills is 7.4%. If you expect the market to earn a return of 12 % should you follow Mohan’s suggestion?

Section A (1 Mark)

Gift received is not taxable in hands of

Section C (4 Mark)

Mr. XYZ buys a Nifty Call with a Strike price Rs. 4100 at a premium of Rs. 170.45 and he sells a Nifty Call option with a strike price Rs. 4400 at a premium of Rs. 35.40.

What would be the Net Payoff of the Strategy?

• if Nifty closes at 4200

• if Nifty closes at 5447

Section B (2 Mark)

Any income chargeable under the based “Salaries” is exempt from tax under Section 10(6)(viii), if it is received by any non resident individual as remuneration for services rendered in connection with his employment in a foreign ship where his total stay in India does not exceed a period days in that previous year.

Section A (1 Mark)

Income which accrue or arise outside India but are received directly in India are taxable in case of:

Section B (2 Mark)

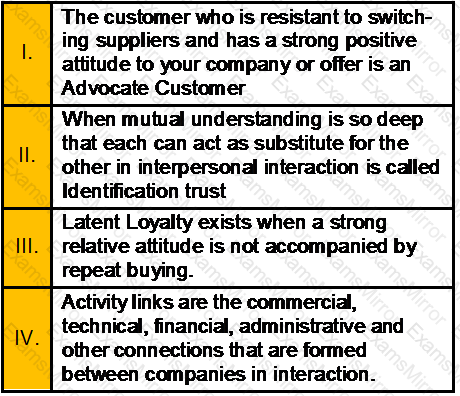

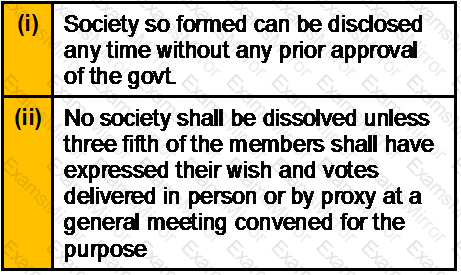

Which of the following statements is/are correct?

Section B (2 Mark)

Which of the following statements is / are correct?

Section A (1 Mark)

An individual is said to be a resident in India in the previous year (in which the Feb month has 29 days) if he is in India in that year for a period of ______days or more.

Section A (1 Mark)

If a testator makes a will ‘to induce another person to make him comply with his (testators) wish’ but does not have any testamentary operation or intention, then this will is called as

Section B (2 Mark)

An investor expects the price of a stock to double after eight years. What is the expected annual rate of growth?

Section A (1 Mark)

The covariance of the market returns with the stocks returns is 0.007. The standard deviation of the market is 7% and standard deviation of stock’s return is 10%. What is the correlation coefficient between stocks and market returns?

Section A (1 Mark)

The inventory turnover ratio and days sales outstanding (DSO) are two ratios that can be used to assess how effectively the firm is managing its assets in consideration of current and projected operating levels.

Section B (2 Mark)

How much loan can be given from PPF account in the year 2006-07?

Section A (1 Mark)

Trust banks are ____________

Section C (4 Mark)

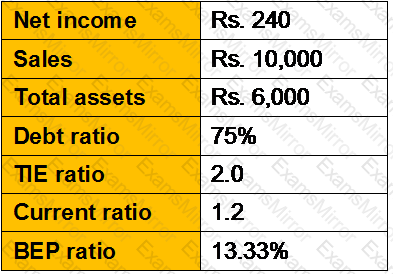

Tapley Dental Supply Company has the following data:

If Tapley could streamline operations, cut operating costs, and raise net income to Rs300, without affecting sales or the balance sheet (the additional profits will be paid out as dividends), by how much would its ROE increase?

Section B (2 Mark)

Which one of the above statements is/are correct?

Section A (1 Mark)

Independent Individualist has __________ risk tolerance

Section A (1 Mark)

Which among the following is not an advantage of setting up a trust?

Section B (2 Mark)

Which of the following is true with regard to wealth planner’s liability?

Section C (4 Mark)

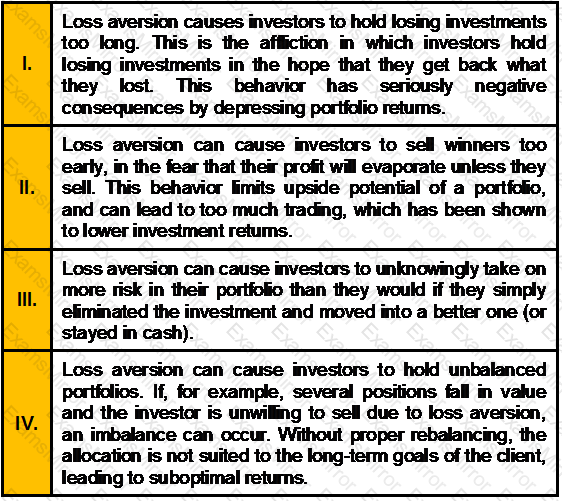

Which of the following statements is/are correct?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.