Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the AFP Certification CTP Questions and answers with ExamsMirror

Exam CTP Premium Access

View all detail and faqs for the CTP exam

796 Students Passed

84% Average Score

90% Same Questions

In analyzing the costs for services among several banks, a cash manager should compare all of the following EXCEPT the:

When investing in commercial paper, the investor's primary consideration should be which of the following?

Which of the following companies would be MOST LIKELY to use a wholesale lockbox?

Which of the following investment instruments is a discount instrument?

Which of the following is responsible for examining national banks?

A netting system can be used for all of the following EXCEPT:

Which of the following is a negotiable time draft?

A retail chain with 500 locations throughout the United States would use which of the following systems?

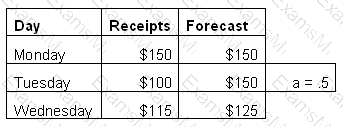

On the basis of the data above,

what is the forecast for Thursday's cash receipts, under the exponential smoothing method?

A manufacturing company selling engines and other mechanical equipment, with invoices averaging $15,000, would use which of the following systems?

Insurance companies often use which of the following payment instruments?

A company receives proceeds of $1,119,274 from the sale of $1,150,000 worth of commercial paper. The paper is outstanding for 95 days. If a 360-day year is used, the company's annual interest rate is closest to which of the following?

Components of a field banking system include which of the following?

I. Local bank

II. Concentration bank

III. Lockbox bank

A cash manager invests in Treasury bills for which of the following reasons?

A prearranged ACH payment normally includes which of the following?

I. A fixed payment amount

II. A provision for immediate availability

III. A predetermined payment date

Which of the following is an advantage of a decentralized disbursement system?

Which of the following will exempt commercial paper from SEC registration?

I. A maturity of fewer than 270 days

II. A rating grade of A-1 or P-1

III. Distribution through a licensed dealer

IV. Backing by a U.S. bank letter of credit

The time between the payor's mailing of a check and the payee's receipt of usable funds is known as:

A cash manager should use which of the following techniques to measure the differences among cash flows with different timings and amounts?

Cash management services commonly used outside the United States include which of the following?

I. Interest-bearing deposit accounts

II. Controlled disbursement systems

III. Pooling of bank accounts

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.