Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the AIWMI CCRA CCRA-L2 Questions and answers with ExamsMirror

Exam CCRA-L2 Premium Access

View all detail and faqs for the CCRA-L2 exam

671 Students Passed

93% Average Score

97% Same Questions

Loss assets should be written off. If loss assets are permitted to remain in the books for any reason,

______percent of the outstanding should be provided for.

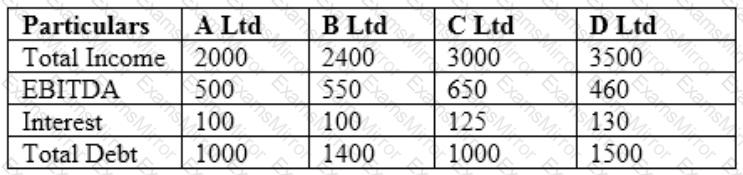

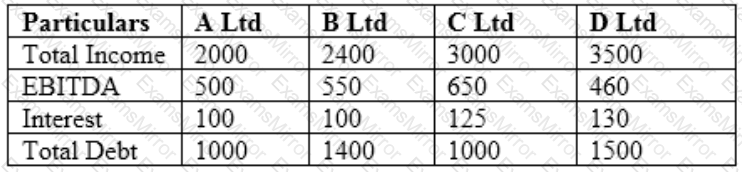

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

Which of the four entities has best interest coverage ratios?

The most important metric for a bank is the Net Interest Income (NII) which is the difference

between____income and____expense.

Mark Construction Company (MCC) has bagged a contract for construction of a large dam and hydro power project on river Shivna in Madhya Pradesh (MP). The project is also of relevance from the irrigation perspective due to its location and as per the agreement MCC will have to undertake construction of web of canals, approach road to dam, power house and other ancillary units. MCC is promoted by Mr. Thomas Mark, who is a MP from the ruling party which recently formed government in MP. Historically, MCC has been engaged into construction of rural roads, small bridges and railway platforms on contract basis for the Government. MCC will have a separate special purpose vehicle (SPV) floated for this venture.

The hydro power project comes under the public private partnership scheme of the Government of MP, where in the private partner builds owns operates and transfers (BOOT) the hydro power plant. The detailed terms of the hydro power project agreement are as follows:

1. The construction of the dam, canals and hydro power plant shall be undertaken by the contractor. The

Government of MP will have to acquire land which will submerge on construction of dam and shall rehabilitate the owners of land.

2. MCC shall have right to operate the hydro power project from date of commencement of commercial operations (DCCO) for a period of 20 years and shall transfer the project to Government thereafter. Further,

SPV shall be tax exempt for a period of five years from DCCO i.e. FY17-FY21.

3. The power project is of 600 megawatts (MW) shall comprise 4 units of 150 MW each. The estimated cost of project is about INR3, 500 Million to be spent over a period of 4 year(s) the project is estimated to be commercially operational by April 1, 2016 with two units operational om same day and one unit each will be operational on April 1, 2017 and April 1, 2018.

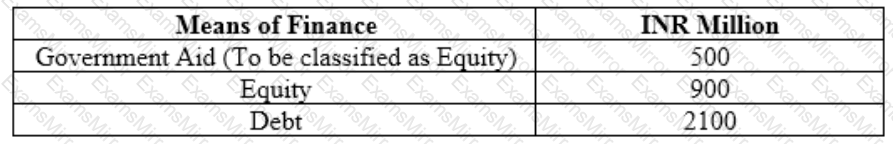

4. Means of finance:

Means of Finance INR Million

Government Aid (To be classified as Equity) 500Equity 900 Debt 2100

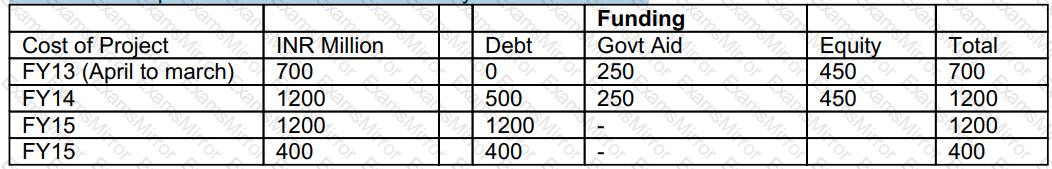

5. Amount if expenditure estimated in various years is as follows:

Debt shall bear a fixed rate of interest of 10% and all interest till DCCO shall be added to the principal. The expected principal along with capitalized interest is expected to be INR2, 400 Million (i.e.INR2100 Million debtplus INR300 Million capitalized interest). The repayment of the same shall be in 12 equated annual installments starting from FY17.

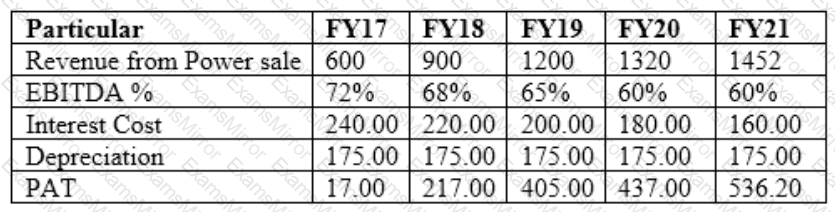

Brief projections for the period of FY17 to FY21 are given below:

Developments as on March 31, 2015

The project manager for the SPV made following comments at a press conferee on March 31, 2015:

As you all are aware, we were running bang on schedule till we last met on December 21, 2014. From today we are just left with one more year to complete the project in time. However, the flash floods which struck our dam site on this March 15, 2015 have created havoc in the region. I shall not point out the loss of lives in the region as you all are well aware of those. Our project has also been badly hit due to the same and we have been assessing the damage over the last one week. After analyzing damage, we have made changes in project schedule. Now we will be making only one unit of 150 MW operational on April 1, 2016 and 1 unit each will be added in each of subsequent year(s).

Development as on September 30, 2015

Post the flash floods, lot of environmentalists started raising issues of changes in environment due to construction of large number of dams. A few Public Interest Litigations (PILs) have been filed in various courts.

Honorable High Court of MP on September 27, 2015, banned construction of any dams in the region and banned permissions for new dams till next hearing scheduled on November 30, 2015. MCC in its press release has indicated that they will apply to the higher court on the matter.

As a credit rating analyst on September 30, 2015, on receipt of the high court order, what rating action you will take:

Short term rates are determined by____________

Satish Dhawan, a veteran fixed income trader is conducting interviews for the post of a junior fixed income trader. He interviewed four candidates Adam, Balkrishnan, Catherine and Deepak and following are the answers to his questions.

Question 1: Tell something about Option Adjusted Spread

Adam: OAS is applicable only to bond which do not have any options attached to it. It is for the plain bonds.

Balkishna: In bonds with embedded options, AS reflects not only the credit risk but also reflects prepayment risk over and above the benchmark.

Catherine: Sincespreads are calculated to know the level of credit risk in the bound, OAS is difference between in the Z spread and price of a call option for a callable bond.

Deepark: For callable bond OAS will be lower than Z Spread.

Question 2: This is a spread that must be added to the benchmark zero rate curve in a parallel shift so that the sum of the risky bond’s discounted cash flows equals its current market price. Which Spread I am talkingabout?

Adam: Z Spread

Balkrishna: Nominal Spread

Catherine: Option Adjusted Spread

Deepark: Asset Swap Spread

Question 3: What do you know about Interpolated spread and yield spread?

Adam: Yield spread is the difference between the YTM of a risky bond and the YTM of an on-the-run treasury benchmark bond whose maturity is closest, but not identical to that of risky bond. Interpolated spread is the spread between the YTM of risky bond and the YTM of same maturity treasury benchmark, which is interpolated from the two nearest on-the-run treasury securities.

Balkrishna: Interpolated spread is preferred to yield spread because the latter has the maturity mismatch, which leads to error if the yield curve is not flat and the benchmark security changes over time, leading to inconsistency.

Catherine: Interpolated spread takes account the shape of the benchmark yield curve and therefore better

than yield spread.

Deepak: Both Interpolated Spread and Yield Spread rely on YTM which suffers from drawbacks and inconsistencies such as the assumption of flat yield curve and reinvestment at YTM itself.

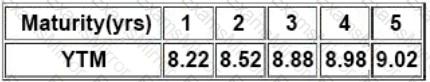

Then Satish gave following information related to the benchmark YTMs:

There is a 10.25% risky bond with a maturity of 4.75 year(s). Its current price is INR105.31, which corresponds

to YTM of 9.22%. Compute Interpolated Spread from the information provided in the vignette:

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

From the data given below, calculate the standard deviation of the credit portfolio assuming that facility’s exposure is known with certainty, customer defaults and LGDs are independent of one another and LGDs are independent across borrower(s).

Credit Facility A – Loss Equivalent Exposure of $60m, expected Default frequency of 1.5%, loss given default

of 30%, Std Deviation of LGD – 5% and Correlation to portfolio – 0.10

Credit Facility B – Loss Equivalent Exposure of $25m, expected Default frequency of 2%, loss given default of 12%, Std Deviation of LGD – 12% and Correlation to portfolio – 0.45

Credit Facility C – Loss Equivalent Exposure of $15m, expected Default frequency of 5%, loss given default of 85%, Std Deviation of LGD – 18% and Correlation to portfolio – 0.22

Based on the Moody’s KMV model which of the following is not correct?

Which of the following is not an importance of the sovereign rating?

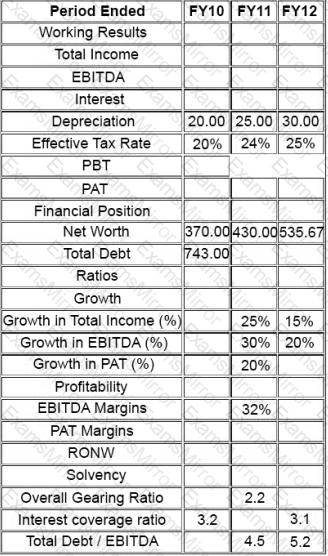

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh Airlines Ltd, a company operating chartered aircrafts in India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

What is Total Income FY10 and FY12?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.