Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the CIMA Certificate BA2 Questions and answers with ExamsMirror

Exam BA2 Premium Access

View all detail and faqs for the BA2 exam

743 Students Passed

88% Average Score

91% Same Questions

A fixed budget is:

In an integrated cost and financial accounting system, the accounting entries for the purchase of raw material on credit would be:

Refer to the exhibit.

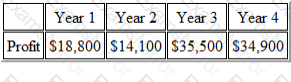

A machine costing $47,000 will generate the following accounting profits:

The annual charge for depreciation is $9,000.

The cost of capital is 12%.

The net present value of the investment in the machine is:

Refer to the exhibit.

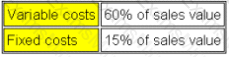

BF plc manufactures and sells a single product. Budgeted figures for next year are as follows:

BF plc is considering increasing its selling price by 5%. It is anticipated that fixed costs, variable costs per unit and sales volume will remain unchanged.

What would be the effect on BF plc's contribution if selling prices are increased?

Refer to the exhibit.

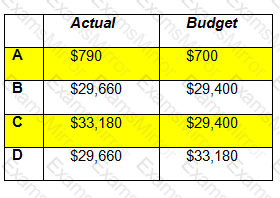

A company budgeted to provide 700 units of service last period for a budgeted variable overhead cost of $29,400. During the period a total of 790 units of service were provided and the variable overhead cost incurred was $29,660.

For effective control of variable overhead cost which two figures should be compared in the budgetary control statement?

A company wishes to achieve a 20% return on the capital of $937,500 invested in the company. Total costs for the next period are budgeted to be $1,250,000.

The standard cost for product P is $11 per unit.

In order to achieve the required return on investment the selling price per unit of product P must be:

Give your answer to 2 decimal places.

Refer to the exhibit.

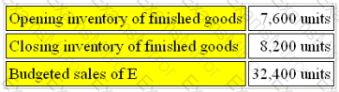

Budgeted data for the month of August for product E is given below:

Each unit of E takes 8 labour hours to make and due to stringent quality control standards, 5% of units are rejected after completion.

The direct labour hour budget for the month of August is:

An increase in variable costs per unit, where selling price and fixed costs remain constant, will result in which of the following:

In an integrated cost and financial accounting system, the accounting entries for PAYE deducted from gross wages would be:

The standard material content of 1 unit of PAJ is £200 (8Kg at £25 per Kg).

During Period 5, 1300 Kg of materials were purchased at a total cost of £35000 and were used to produce 170 units of PAJ.

What was the materials price variance for Period 5?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.