Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the CIMA Operational F1 Questions and answers with ExamsMirror

Exam F1 Premium Access

View all detail and faqs for the F1 exam

739 Students Passed

95% Average Score

94% Same Questions

MN recently took out a 5 year term loan to buy raw materials to take advantage of a supplier's bulk discount that had been offered to them.

What approach to financing working capital has MN undertaken?

In most developed countries employers deduct the tax from employees' pay each month and then pay the tax to the tax authorities on behalf of the employee on a monthly basis.

Which THREE of the following are advantages of this system to the employee?

YZ has $40,000 of plant and machinery which was acquired on 1 June 20X1.Tax depreciation rates on plant and machinery are 25% reducing balance. All plant and machinery was sold for $24,000 on 1 June 20X3.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 May 20X3 and state the effect on the taxable profit.

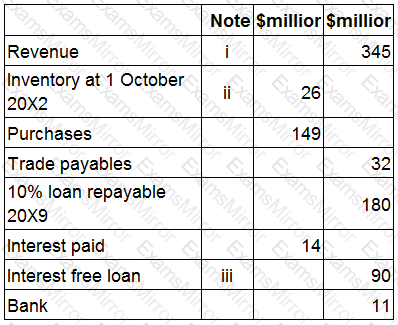

The following information is extracted from the trial balance of YY at 30 September 20X3.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the figure that should be included within non-current liabilities in YY's statement of financial position at 30 September 20X3 in respect of both of the loans outstanding at the year end?

Give your answer to the nearest $ million.

If a parent entity is to be exempt from preparing consolidated financial statements it needs to satisfy certain conditions according to IFRS 10 Consolidated Financial Statements.

Which TWO of the following are conditions that need to be satisfied to be exempt?

An entity bought a capital item for $110,000 on 1 March 20X4 incurring legal fees at the date of purchase of $2,500.

On 1 May 20X4 additional costs classified as capital expenditure by the tax rules of the country of $25,000 were incurred in respect of the asset. On 1 June 20X4 repairs not classified as capital expenditure were incurred at a cost of $15,000.

The asset was sold for $250,000 on 30 November 20X8 and costs to sell were incurred of $4,300.

Calculate the chargeable gain on the disposal.

Give your answer to the nearest $.

Mr AM is the owner of Waxco Ltd. Mr AM was born in India, but currently resides in the USA. He has gained dual Indian and American citizenship.

Mr AM first registered Waxco Ltd in the USA when he started the company ten years ago. However, because of lower costs, the company moved its central management station to Germany two years ago. Waxco Ltd

has other smaller offices such as call centres across Asia, in locations such as Pakistan and Cambodia, however Waxco Ltd only currently sell goods in the USA.

Which of the countries mentioned are relevant for determining Waxco Ltd's competent jurisdiction?

ABC uses an aggressive approach to managing its working capital. XYZ uses a conservative approach to managing its working capital.

Which of the following is ABC more at risk of compared to XYZ?

Which of the following is not a possible tax rate structure?

Which THREE of the following would be included in a cash budget?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.