Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the CIMA Management F2 Questions and answers with ExamsMirror

Exam F2 Premium Access

View all detail and faqs for the F2 exam

669 Students Passed

91% Average Score

96% Same Questions

RST sells computer equipment and prepares its financial statements to 31 December.

On 30 September 20X5 RST sold computer software along with a two year maintenance package to a customer. The customer is given the right to return the goods within six months and claim a full refund if they are not satisfied with the computer software. The risk of return is considered to be insignificant for RST.

How should the revenue from this transaction and the right of return be recognised in the financial statements for the year ended 31 December 20X5?

EF has redeemable 10% bonds which are currently trading at $94.00 for each $100 of nominal value. The bonds can be redeemed at par in five years' time. The corporate income tax rate is 22%.

The present value of the cash flows associated with $100 nominal value of these bonds at a discount rate of 7% is $9.28.

Calculate the post tax cost of debt.

Give your answer as a percentage to one decimal place.

%

ST acquired 70% of the equity shares of DE for $87,500 on 30 September 20X5. At the date of acquisition the net assets of DE were $54,700 and the fair value of the non controlling interest was measured at $19,700. There has been no impairment of goodwill.

On 30 September 20X9 ST disposed of its entire investment in DE for $262,500 when the net assets of DE were $96,250.

What is the gain or loss on disposal of DE that will be included in ST's consolidated profit or loss for the year ended 30 September 20X9?

JJ's current share price is $1.80, with a dividend of $0.20 a share just about to be paid.

Dividends have increased at an average annual growth rate of 4.5% and this is expected to continue into the future.

What is JJ's cost of equity?

The consolidated statement of profit or loss for VW for the year ended 30 September 20X7 includes the following:

What is VW's interest cover for the year ended 30 September 20X7?

CD granted 1,000 share options to its 100 employees on 1 January 20X8.To be eligible, employees must remain employed for 3 years from the grant date. In the year to 31 December 20X8, 15 staff left and a further 25 were expected to leave over the following two years.

The fair value of each option at 1 January 20X8 was $10 and at 31 December 20X8 was $15.

Which THREE of the following are true in respect of recording these share options in the year ended 31 December 20X8?

Which TWO of the following are true in relation to IAS21 The Effects of Changes in Foreign Exchange Rates when consolidating an overseas subsidiary?

What is the total comprehensive income attributable to the shareholders of GHI that will be presented in GHI's consolidated statement of changes in equity for the year ended 31 December 20X4?

ST owns 75% of the equity share capital of GH. GH owns 80% of the equity share capital of RS.

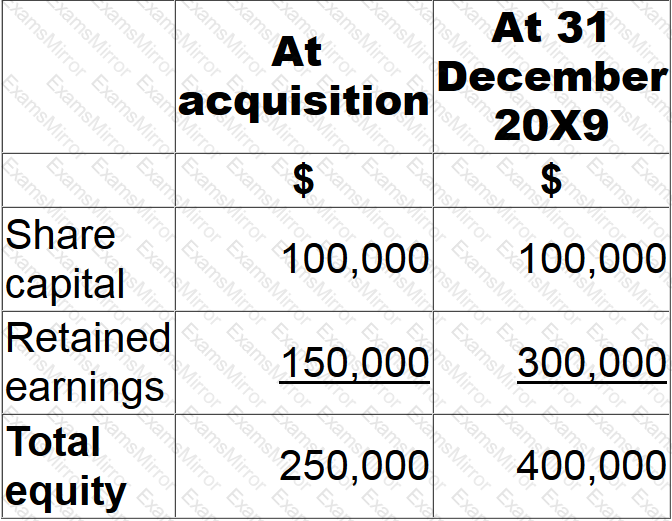

The following balances relate to RS:

The non controlling interest in respect of RS had a fair value of $56,000 at acquisition. There has been no impairment to goodwill since acquisition.

What value should be included in ST's consolidated statement of financial position for the non controlling interest in RS at 31 December 20X9?

DE acquired 10% of the equity shares of KL on 31 December 20X2.

A further 50% of the equity shares of KL were acquired by DE on 1 January 20X4.

Which THREE of the following would be part of the process for recording the second purchase of shares?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.