Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the CIMA Operational P1 Questions and answers with ExamsMirror

Exam P1 Premium Access

View all detail and faqs for the P1 exam

657 Students Passed

91% Average Score

93% Same Questions

Which of the following would help to explain a favourable material price variance?

The term ‘budgetary slack’ refers to the:

Budgeted sales and production for Product X for this period are 12,000 units.

The standard cost and selling price for a single unit of the product are:

The fixed production overhead expenditure variance is:

A company currently uses a rate of $32 per machine hour to absorb its total production overheads of $960,000.

Using this system the production overhead cost per unit of product X is $160.

An activity based costing exercise has revealed that only $345,000 of the production overhead is driven by machine hours. The remainder is driven by the number of machine set ups, at a rate of $9.60 per set up.

Product X requires 3 set ups per unit.

Calculate the total production overhead cost per unit of product X using an activity based costing system.

Give your answer to two decimal places.

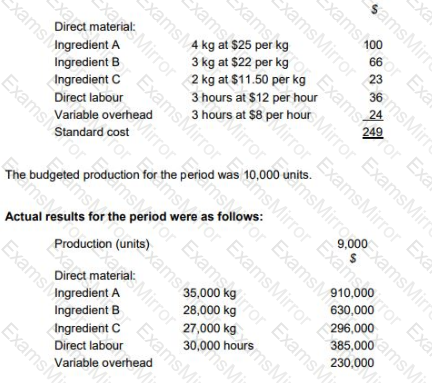

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers’ specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

What was the material yield variance?

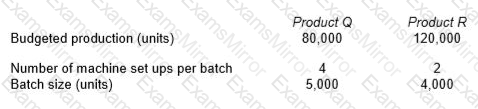

QR uses an activity based budgeting (ABB) system to budget product costs. It manufactures two products, product Q and product R. The budget details for these two products for the forthcoming period are as follows:

The total budgeted cost of setting up the machines is $74,400.

Select TWO potential benefits of using an activity based budgeting system.

In short-term decision making, which TWO of the following are relevant costs?

A company produces and sells more than one product.

All products are manufactured using the same facilities and incur common fixed costs.

Which of the following is used to calculate the break-even sales revenue for the business?

A company accountant is trying to determine the optimum production plan for the period using linear programming.

The accountant has correctly formulated the linear programming problem as follows:

Variables (products): x and y

Objective function: Maximise contribution, C = 10x + 15y

Material constraint: 4x + 6y ≤ 500 (kg)

Labour constraint: x + 2y ≤ 350 (hours)

Machine constraint: 10x + 4y ≤ 1,500 (hours)

x constraint: 50 ≤ x ≤ 200

y constraint: y ≥ 0

Which of the following statements is true?

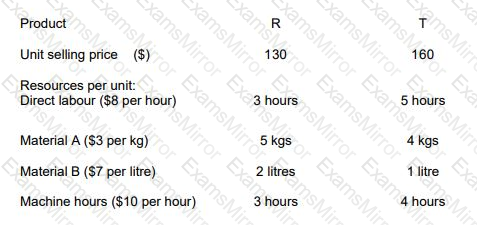

RT produces two products from different quantities of the same resources using a just-in-time (JIT) production system. The selling price and resource requirements of each of the products are shown below:

Market research shows that the maximum demand for products R and T during June 2010 is 500 units and 800 units respectively. This does not include an order that RT has agreed with a commercial customer for the supply of 250 units of R and 350 units of T at selling prices of $100 and $135 per unit respectively. Although the customer will accept part of the order, failure by RT to deliver the order in full by the end of June will cause RT to incur a $10,000 financial penalty. At a recent meeting of the purchasing and production managers to discuss the production plans of RT for June, the following resource restrictions for June were identified:

Direct labour hours 7,500 hours

Material A 8,500 kgs

Material B 3,000 litres

Machine hours 7,500 hours

Assuming that RT completes the order with the commercial customer, prepare calculations to show, from a financial perspective, the optimum production plan for June 2010 and the contribution that would result from adopting this plan.

The optimum production plan will be:

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.