Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the IFSE Institute Investments & Banking CIFC Questions and answers with ExamsMirror

Exam CIFC Premium Access

View all detail and faqs for the CIFC exam

686 Students Passed

89% Average Score

95% Same Questions

When comparing the current yield and yield-to-maturity of a bond, which statement applies?

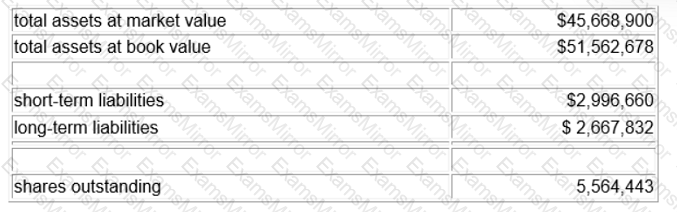

At 4:00 p.m. Eastern Time on July 6, the following information is collected for the Marigold Canadian Dividend Fund:

What is the net asset value per unit NAVPU for the Marigold Canadian Dividend Fund for July 6?

Which statement CORRECTLY describes index mutual funds and traditional exchange-traded funds (ETFs)?

Your client, Cosmo, recently inherited $50,000 from his uncle. He wants to use this money towards his retirement savings. Cosmo is a 50-year old, self-employed carpenter and he earns on average $65,000

per year. He has a registered retirement savings plan (RRSP) with the bank worth $425,000 and a tax-free savings account (TFSA) worth $46,000. He started saving when he was 25 years old and has always

made his own investment decisions. His money is mostly invested in balanced funds. He feels most comfortable with these types of mutual funds since they offer potential investment growth but without being too aggressive. Cosmo has no other assets.

What additional information do you need about Cosmo to fulfill your know your client obligation?

When you buy a put option, which of the following is TRUE?

Pierre wants to discuss the merits of a specific mutual fund with his Dealing Representative, Simone. There are no trailer fees associated with this fund. Simone is familiar with the mutual fund that Pierre is referring to, which is not offered by her dealer. They schedule an appointment to further discuss his investment portfolio.

Which behaviour from Simone is ethical?

Pippa purchased a 15-year bond with a face value of $5,000 and a 7% coupon rate at the time of issuance. The bond is due to mature later this year. The general interest rate climate remained stable for the first 13 years of the bond's term. However, especially over the past 18 months, both inflation and general interest rates have increased more than expected.

What is Pippa likely to experience from her bond?

Quinton, a Dealing Representative, meets with his client Banji. Banji’s Know Your Client (KYC) indicates that her risk profile is “medium’’. Banji currently has $35,000 in her account which is invested 50% in the Middleton Balanced Fund and 50% in the Hector Growth Fund. She tells Quinton that she would like to contribute an additional $10,000 to purchase the Prospect Labour-Sponsored Fund. Which of the following statements about Banji’s proposed transaction is CORRECT?

Taylor is chatting with other parents in the park when the conversation turns to registered education savings plans (RESPs). Taylor thinks that most of what they are saying is incorrect. Which of the following

statements about self-directed RESPs is TRUE?

Sven owns preferred shares that give him the option to sell his holdings back to the issuing company at a predetermined price and within a specified time. What type of preferred shares does Sven own?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.