Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the Pegasystems Pega Decisioning Consultant PEGACPDC88V1 Questions and answers with ExamsMirror

Exam PEGACPDC88V1 Premium Access

View all detail and faqs for the PEGACPDC88V1 exam

639 Students Passed

90% Average Score

97% Same Questions

A decisioning architect wants to use the customer properties income and age in a Filter component. Which decision component is required to enable access to these properties?

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website. What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

U+ Bank, a retail bank, uses the business operations environment to perform its business changes. The bank completes these changes by using revision management features of Pega Customer Decision Hub™ and 1:1 Operations Manager.

Customers see credit card offers based on various engagement policies on the U+ Bank website. The bank wants to update the underlying decision strategy of

an engagement policy condition.

According to best practices, which statement correctly describes the implementation of the change to fulfill this business requirement?

As a decisioning architect, you advise the board on the business issues for which they must use the Next-Best-Action strategy. Which three business issues do you recommend? (Choose Three)

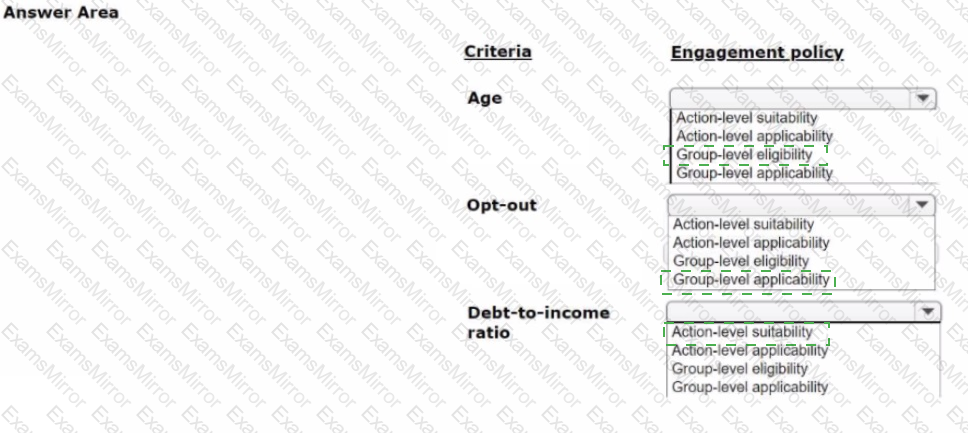

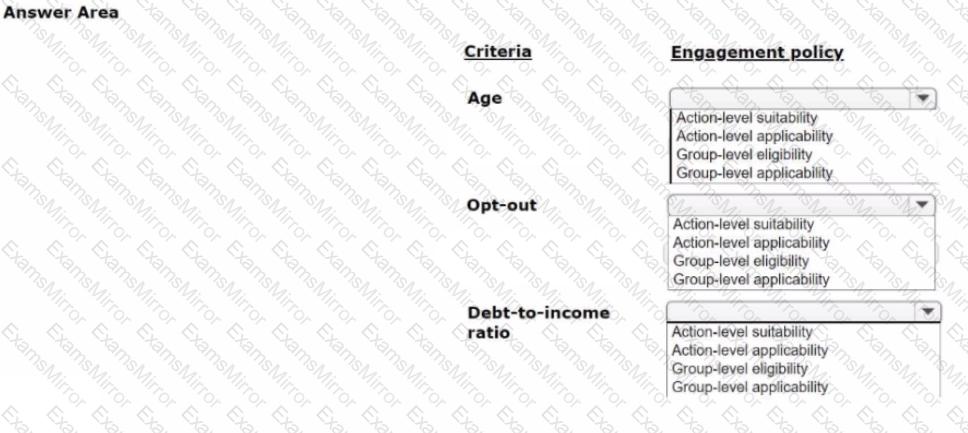

U+ Bank decides to introduce a credit cards group by leveraging the Next-Best-Action capability of Pega Customer Decision Hub™. The bank wants to present the credit card offers through inbound and outbound channels based on the following criteria:

1. Customers must be above the age of 18 to qualify for credit card offers.

2. The site offers credit cards only if customers do not explicitly opt-out of any direct marketing for credit cards.

3. The Platinum Card, one of the credit card offers, is suitable for customers with debt-to-income ratio < 45.

As a decisioning architect, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

A financial institution has created a new policy that states the company will not send more than 500 emails per day. Which option allows you to implement the requirement?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

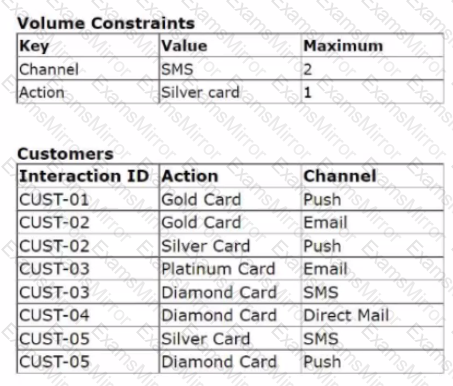

A volume constraint uses the Return any action that does not exceed

constraint mode. The following tables show the configuration of the volume constraints and the list of customers in the outbound segment:

The outbound run selects customers in the following order to apply the volume constraints: CUST-01, CUST-02, CUST-03, and CUST-05.

Based on the configuration of the volume constraints for each channel, which offer does CUST-05 receive?

U+ Bank presents various credit card offers to its customers on its website. The bank uses AI to prioritize the offers according to customer behavior. With the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

MyCo, a telecom company, wants to introduce a new group of offers called Tablets for all customers. As a decisioning architect, which two valid actions do you create? (Choose Two)

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.