Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the Pegasystems Pega Decisioning Consultant PEGAPCDC87V1 Questions and answers with ExamsMirror

Exam PEGAPCDC87V1 Premium Access

View all detail and faqs for the PEGAPCDC87V1 exam

629 Students Passed

87% Average Score

92% Same Questions

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

A bank has chosen an email service provider to deliver the offer messages selected by Pega Customer Decision Hub. The service provider prefers that the bank uploads a file per batch of customers to a cloud storage location, either on Microsoft Azure or Amazon S3. As a consultant working on the project representing the bank, what is your response?

A bank wants to add a contact policy that will suppress an action for 20 days if it was rejected twice in any channel in the last 30 days. How do you define the suppression rule for the contact policy?

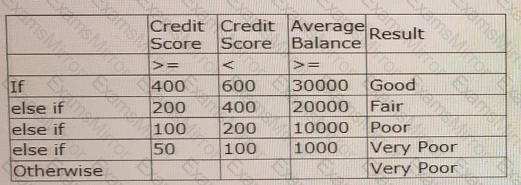

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

A bank wants to present the Rewards Card offer on the top right of the customers’ account page when they log in. Select the placement type of the treatment design.

A bank developed a scorecard to automate the loan approval process. In a decision strategy, how do you use the raw score value computed by the scorecard?

U+ Bank’s marketing department currently promotes various credit card offers by sending emails to qualified customers. Now the bank wants to limit the number of emails sent to their customers irrespective of past outcomes with a particular offer and customer. Which of the following options allows you to implement this business requirement?

MyCo, a telecommunications company, wants to implement one-to-one customer engagement using Pega Customer Decision Hub™. Which of the following real-time channels can the company use to present Next-Best-Actions? (Choose Three)

For a limited time period, a bank wants to avoid sending promotional emails related to credit card offers to a customer if they have already received one. Which rule do you need to define to implement this business requirement?

Reference module: Adding more tracking time periods for contact policies

A bank is currently displaying a group of mortgage offers to its customers on their website. The bank wants to suppress the mortgage group for 15 days if a customer ignores three offers from the mortgage group. How do you define the suppression rule for this requirement?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.