special code - Ends in 0d 00h 00m 00s - Coupon code = discmirror

Pass the SAP Certified Associate C_THR94_2505 Questions and answers with ExamsMirror

Exam C_THR94_2505 Premium Access

View all detail and faqs for the C_THR94_2505 exam

689 Students Passed

89% Average Score

93% Same Questions

What are some characteristics of Leave of Absence?Note: There are 3 correct answers to this question.

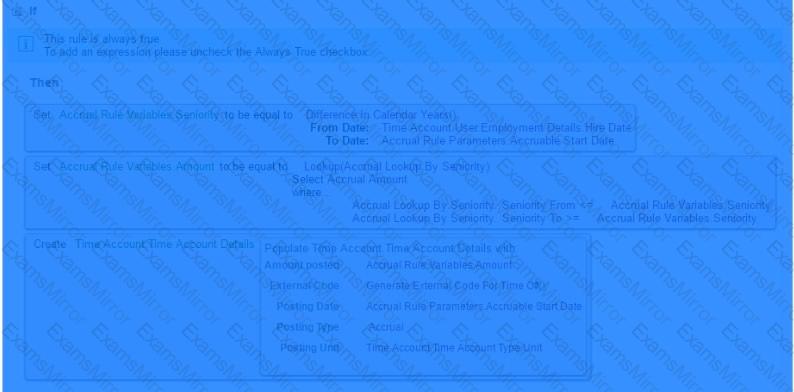

You need to determine the accruals to be awarded based on the seniority of an employee. The employee has been with the organization for 5 years and should be awarded an accrual of 12 days. Here is the accrual rule that you will use:

What are eligible values for the accrual lookup by seniority table? Note: There are 2 correct answers to this question.

Employees in your company can get their Time Account balances paid out. You replicate the Time Account with its related information. As such, Time Account payouts are replicated to infotype 0416.What do you need to keep in mind?

Under which object can you define whether a Time Type is a favorite Time Type?

Which tool do you use to import Work Schedules?

A customer wants to calculate a specific payment for employees working between 7:00 pm to 11:59 pm.In the Time Evaluation rule, what is the appropriate Time Valuation Type to be used to achieve this?

You want to import a leave request for a quarter-day absence on March 23, 2022.What is the correct entry for the Fraction Quantity, Start Date, and End Date?

An employee is hired on January 10, 2022, with yearly accruals as accrual frequency.What is the correct accruable and accrual period combination?

Which of the following can lead to automatic absence recalculation?Note: There are 3 correct answers to this question.

What operations are supported when an employee accesses a Time Event via the Time Sheet UI?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.