Winter Special Limited Time 65% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = discmirror

Pass the WGU Courses and Certificates Financial-Management Questions and answers with ExamsMirror

Exam Financial-Management Premium Access

View all detail and faqs for the Financial-Management exam

432 Students Passed

87% Average Score

92% Same Questions

What is a function of the Financial Industry Regulatory Authority (FINRA)?

What are opportunity costs in the context of inventory management?

What is a benefit of a firm extending credit to customers in a competitive market?

A company is expected to pay a dividend of $2 next year, and dividends are expected to grow at 5% per year indefinitely. The required rate of return on the company’s stock is 10%.

What is the value of the stock using the Gordon growth model?

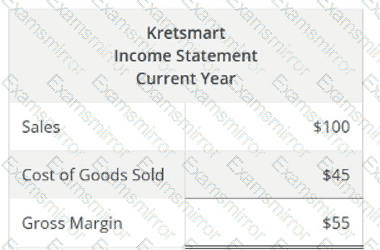

Kretsmart anticipates its sales will grow by10% each year for the next two years. Information from the company’s current income statement is given below, andCost of Goods Sold (COGS) is assumed to be a spontaneous account.

What would the company’sprojected gross margin for Year 2?

How does asset tangibility affect a company’s capital structure?

Which type of security has voting rights associated with it?

What is a drawback of using the Gordon growth model for estimating the cost of common equity?

What is an advantage of using the Gordon growth model to estimate the cost of common equity?

Which practice can help an analyst identify the most relevant financial data and ratios when assessing the financial health of a firm?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.