Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the AAFM Chartered Wealth Manager GLO_CWM_LVL_1 Questions and answers with ExamsMirror

Exam GLO_CWM_LVL_1 Premium Access

View all detail and faqs for the GLO_CWM_LVL_1 exam

701 Students Passed

92% Average Score

97% Same Questions

Rs. 1.50 lakh settled on a trust for the benefit of Akash and Bina for life. They share the income in proportion of 3:2.Their ages on valuation date are 20 years and 16 years. The average annual income for the last three years on the valuation date is Rs. 15,000/-. Find out the value of life interest of Akash and Bina if the value of life interest of Re 1/- at the age of 20 years is 12.273 and at the age of 16 years is 12.534.

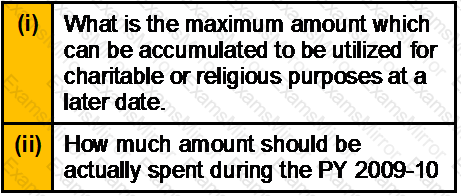

During the PY 2009-10 a Kariwala Charitable Trust earned an income of Rs. 7 lakh out of which Rs.5 lakh was received during the PY 2009-10 and the balance Rs. 2 lakh was received during the PY 2011-2012.In order to claim full exemption of Rs. 7 lakh in the PY 2009-10:

Mr. Munjal has got her daughters son admitted to a dental college today, where he has to pay a fee of Rs. 1.5 Lac today i.e. at the time of admission. Then Rs. 1.75 lacs after 1 year, Rs. 2.5 lacs after 2 years and Rs. 3.25 lacs after 3 years. He wants to set aside the amount required today itself in the form of a Bank FDR.So how much he needs to put aside today if ROI is 8% for 1 year, 8.5% for 2 years and 9% for 3 years, all compounded Quarterly?

You are considering investing in following bond:

Your income tax rate is 34 percent and your capital gains tax is effectively 10 percent. Capital gains taxes are paid at the time of maturity on the difference between the purchase price and par value. What is your approximate post-tax yield to maturity on this bond?

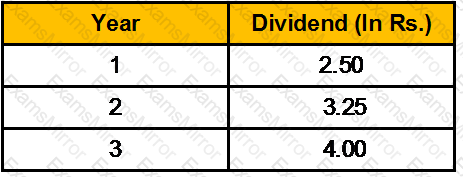

Management has recently announced that expected dividends for the next three years will be as follows:

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

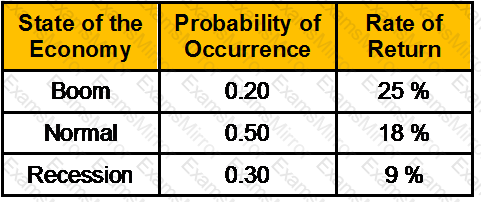

The probability distribution of the rate of return on a stock is given below:

What is the standard deviation of return?

You own 3 scripts with their market value at Start of year end of year (3rd) total growth.

Calculate the CAGR of portfolio.

A rate of interest of 10% semi-annual compounded quarterly would be equal to -------------------- % per annum compounded annually.

Mr. Nitin, a trading and a clearing member, took proprietary position in August 2007 expiry contract. He bought 10000 units of SAIL@ Rs.140 and sold 8000 units @ Rs.143.50. The end of the day settlement price for August 2007 expiry contact is Rs.141. If the initial margin per unit of SAIL for August 2007 is Rs.42 per unit, then the total initial margin payable by Nitin would be_______

Samantha celebrated her 21st birthday today, her father gave her Rs. 6,25,000/- which is deposited in a account that pays a ROI of 12.25% p.a. compounded monthly. If she wants to withdraw Rs. 7,50,000 on her 31st. Birthday and balance on her 41stBirthday. How much can she withdraw on her 41st. birthday.?

You wish to save for your son’s education the present cost of which is Rs. 320000 and is expected to increase by 6% every year. If your son is 12 years old and will require money in 8 years time, what is the annual amount of investment to be made if it is likely to earn 12% rate of return?

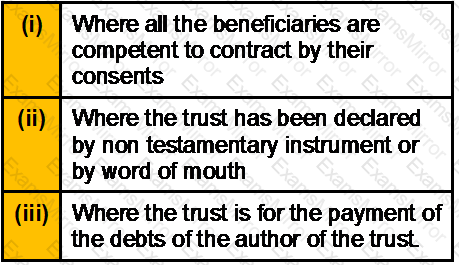

A trust not created by a will can be revoked only

Mr. Rajesh Rawat deposits Rs. 15,000 per month at the end of the month for 6.50 years in an account that pays a ROI of 8.80% per annum compounded quarterly. What will be the amount in the account after 6.50 years.?

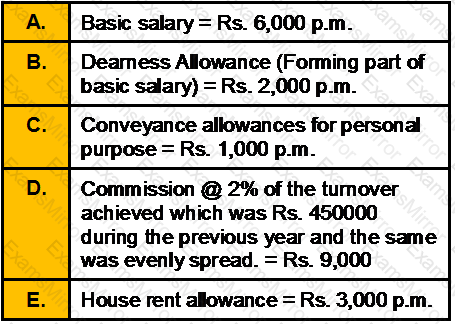

Sudesh Haldia is employed at Delhi as Store Manager in one of the Retail Companies. The particulars of his salary for the previous year 2006-07 are as under:

The actual rent paid by him is Rs. 2,000 p.m. for an accommodation at Noida till 31-12-2006.From 1-1-2007 the rent was increased to Rs. 4000 p.m. Compute the taxable HRA?

Sachin aged 35 years is married and is working as a manager in M/s Birla Mill Ltd. His most likely retirement age is 60 years. His present salary is Rs. 3,00,000/- pa. His self-maintenance expenses are 30,000/- per year. Life insurance premium paid is 15,000/-. Income tax & professional tax amount to Rs. 20000/-. Rate of interest assumed for capitalization of future income is 8%. Calculate Sachin’s HLV to recommend adequate insurance cover

You want to take a trip overseas which costs Rs. 10 lacs. The cost is expected to remain unchanged in nominal terms. You can save annually Rs. 50000 to fulfill the desire. How long will you have to wait if your savings earn an interest rate of 12%?

A property has 120 rooms and each room has a monthly rent of Rs.750. The occupancy rate throughout the year is 80% and maintenance expenses per year works out to be Rs.3,00,000. Capitalization rate is 12%. Calculate the value of the property?

Pankaj is an employee of a private company in Jabalpur. He draws an amount of Rs 36,000pm as basic salary. He also receives Rs 8000 as HRA. He has taken a house on rent from 1st October and pays Rs 10,000pm as rent for his house accomodation. What would be the taxable HRA?

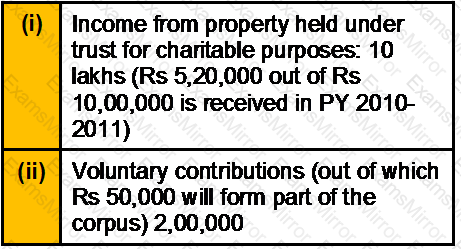

Shri Ganjarwala Charitable Trust (Regd.) submits the particulars of its income/outgoing for the previous year 2009-2010 as below:

The trust spends Rs 2,77,500 during the previous year 2009-2010 for charitable purposes. In respect of Rs 5,20,000, it has exercised its option to spend it within the permissible time-limit in the year of receipt or in the year, immediately following the year of receipt.

The trust spends Rs 2,00,000 during the previous year 2009-2010 and Rs 1,00,000 during the previous year 2010-2011.

Compute the tax payable on the income of the trust.

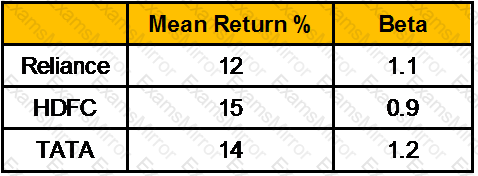

Consider the following information for three mutual funds

Risk free return is 7%. Calculate Treynor measure?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.