Spring Special Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = getmirror

Pass the Pegasystems Pega Decisioning Consultant PEGACPDC25V1 Questions and answers with ExamsMirror

Exam PEGACPDC25V1 Premium Access

View all detail and faqs for the PEGACPDC25V1 exam

628 Students Passed

91% Average Score

96% Same Questions

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

A decisioning architect wants to use the customer properties income and age in a Filter component. Which decision component is required to enable access to these properties?

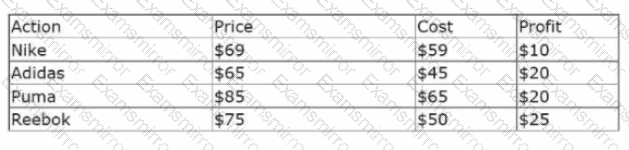

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Prices of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

The details of the shoes are provided in the following table:

To output the most profitable shoe, which component do you add in the blank space that is highlighted in red?

U+ Bank, a retail bank, uses the business operations environment to perform its business changes. The bank completes these changes by using revision management features of Pega Customer Decision Hub™ and 1:1 Operations Manager.

Customers see credit card offers based on various engagement policies on the U+ Bank website. The bank wants to update the underlying decision strategy of

an engagement policy condition.

According to best practices, which statement correctly describes the implementation of the change to fulfill this business requirement?

MyCo, a telecom company, developed a new data plan group to suit the needs of its customers. The following table lists the three data plan actions and the criteria that customers must satisfy to qualify for the offer:

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)

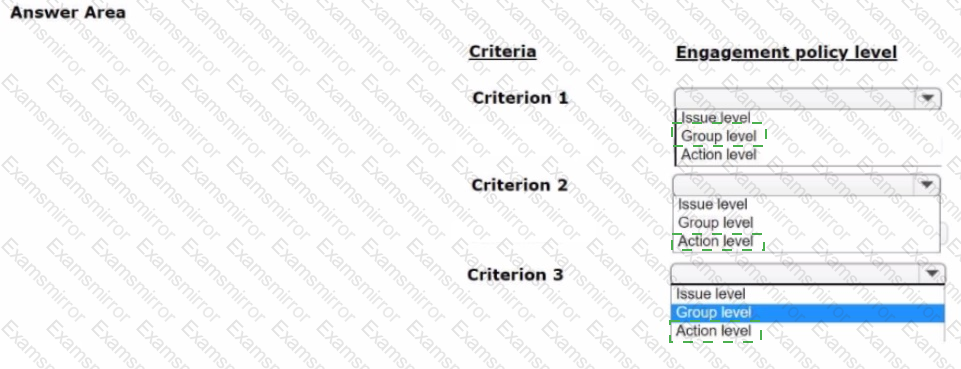

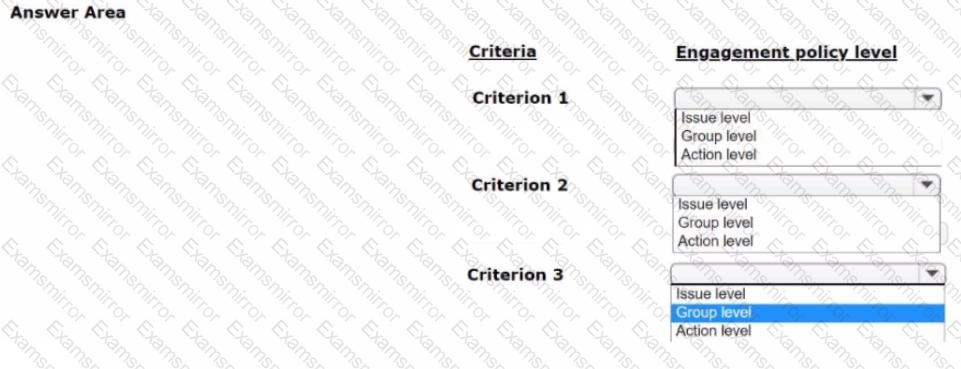

U+ Bank, a retail bank, is designing an engagement policy for its credit card promotions. To meet legal requirements, the bank must ensure that only customers aged 18 or older are considered for any credit card offer.

Which policy configuration level should U+ Bank use to implement the age requirement (18+ years) for all credit card promotions?

MyCo, a telecom company, wants to introduce a new group of offers called Tablets for all customers. As a decisioning architect, which two valid actions do you create? (Choose Two)

A financial institution's NBA team discovers that they need to modify their risk assessment strategy and edit a scorecard used for loan approvals. The team lead reviews the available options in 1:1 Operations Manager to determine the most appropriate approach to implementing these changes.

Which approach should the team lead use to implement these strategy and scorecard modifications?

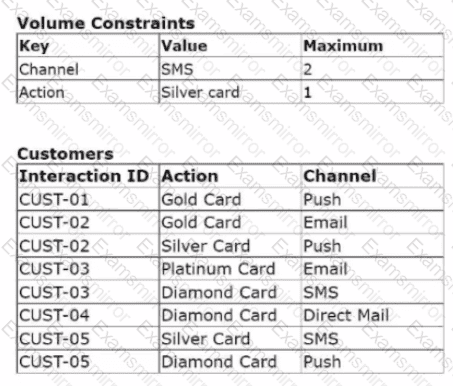

A volume constraint uses the Return any action that does not exceed

constraint mode. The following tables show the configuration of the volume constraints and the list of customers in the outbound segment:

The outbound run selects customers in the following order to apply the volume constraints: CUST-01, CUST-02, CUST-03, and CUST-05.

Based on the configuration of the volume constraints for each channel, which offer does CUST-05 receive?

TOP CODES

Top selling exam codes in the certification world, popular, in demand and updated to help you pass on the first try.